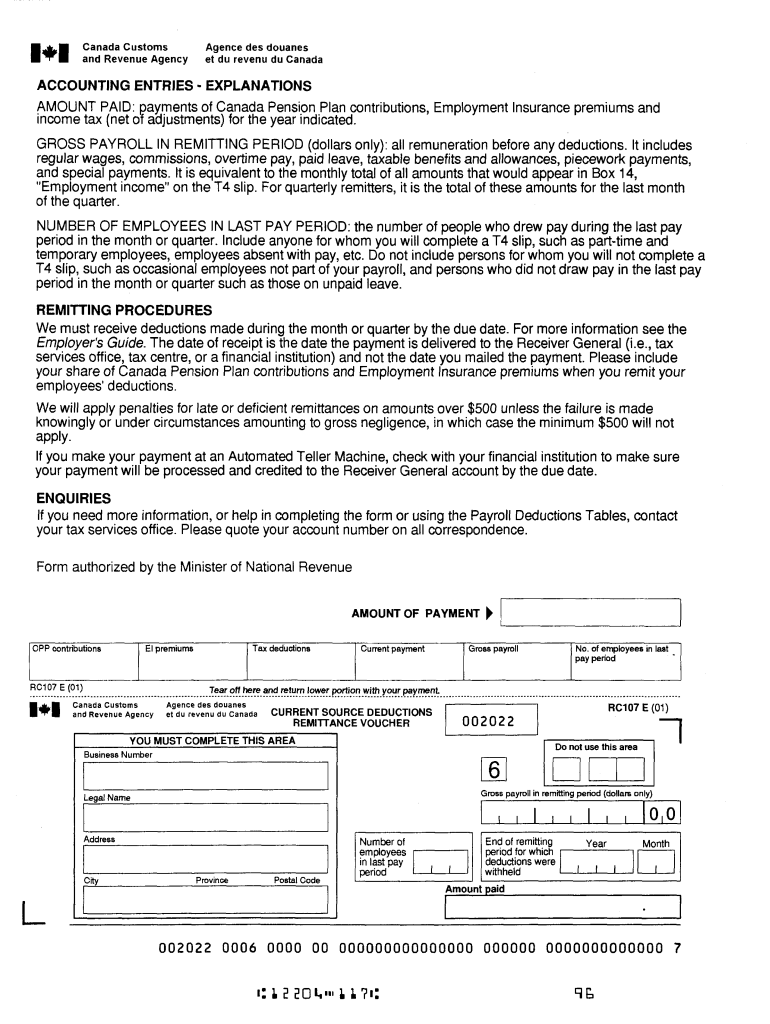

Canada Revenue Agency Corporate Tax Remittance Form Ethel Hernandez's Templates

representative, to get a clearance certificate before you distribute any property or money you control. To ask for a clearance certificate, you have to complete Form GST352, Application for Clearance Certificate, and send it to your tax services office. For more information on clearance certificates related to the GST/HST, call 1-800-959-5525.

A Guide to Canada's Tax Clearance Certificates Passiv

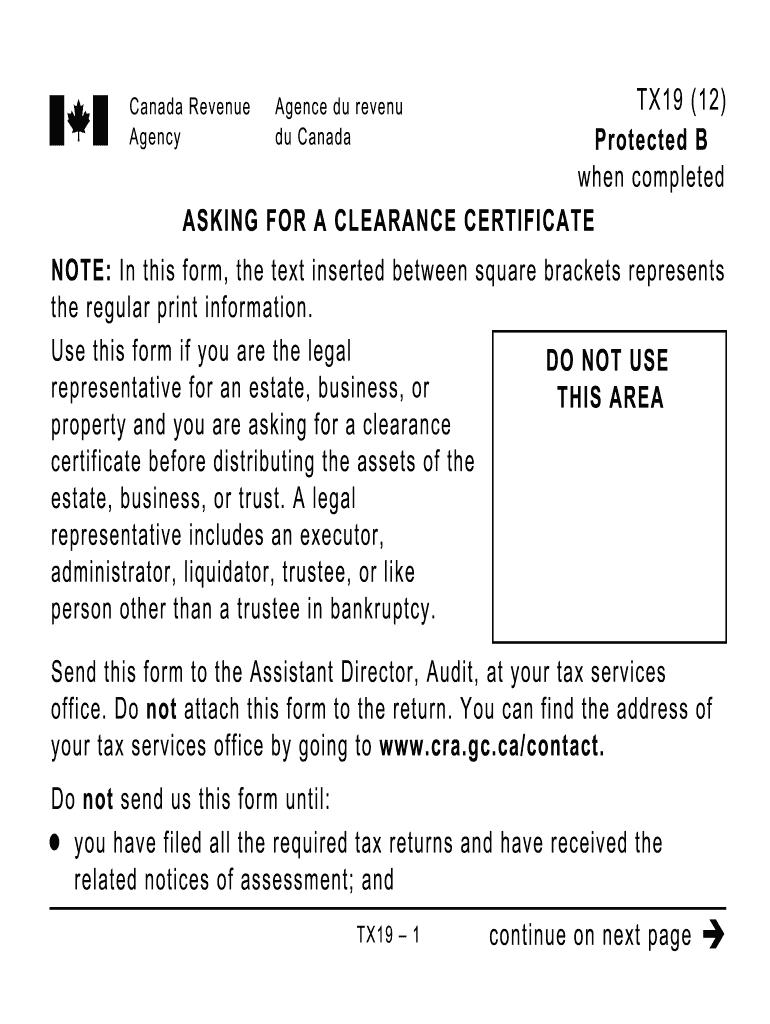

Issuing a Tax Clearance Certificate. Pursuant to the Canada Revenue Agency's Information Circular IC82-6R11, a tax clearance certificate will be issued on "Form TX21, Clearance Certificate" where (a) the applicable income tax returns have been filed and assessed, and (b) amounts for which the taxpayer is liable for have been received or secured.

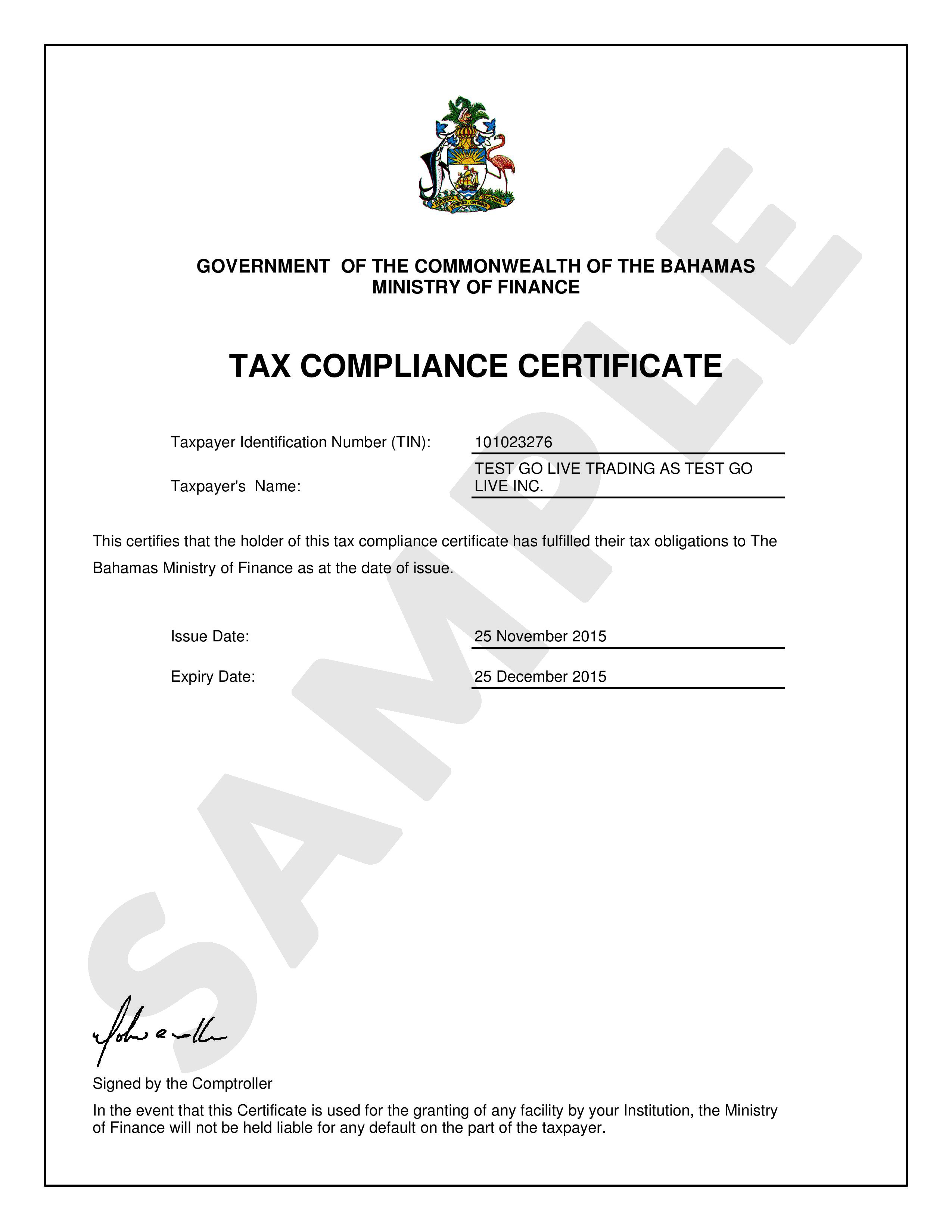

tax clearance certificate

Now the CRA has made it possible for a personal representative to apply for the clearance certificate online through their secure portal. A clearance certificate is requested after: The CRA assessment can take up to 120 days once all necessary documents are submitted. In certain situations, the CRA may need to do an audit before it issues the.

Canada revenue agency ei lalafquick

123RF One of an executor's most important jobs is to obtain the clearance certificate: written confirmation from the Canada Revenue Agency that the deceased (and the deceased's estate) has paid all taxes and associated interest and penalties up to the date the certificate is issued.

Canada revenue agency my account diglasem

In Canada, the Canada Revenue Agency (CRA) would issue the tax clearance certificate. According to the Canada Revenue Agency website the certificate confirms that these entities have paid all, "Amounts of tax, interest and penalties it owed at the time the certificate was issued.". In order to be valid, the certificate must be issued by the.

Canada Revenue Agency Disability Tax Credit Certificate Juno EMR Support Portal

Clearance Certificate and provide the required documents listed on Form TX19. This will help us to issue the certificate without delay. Why you need a clearance certificate 2. Subsection 159(2) of the Income Tax Act (the Act), requires a legal representative, which we define in paragraph 3, to obtain a clearance certificate before

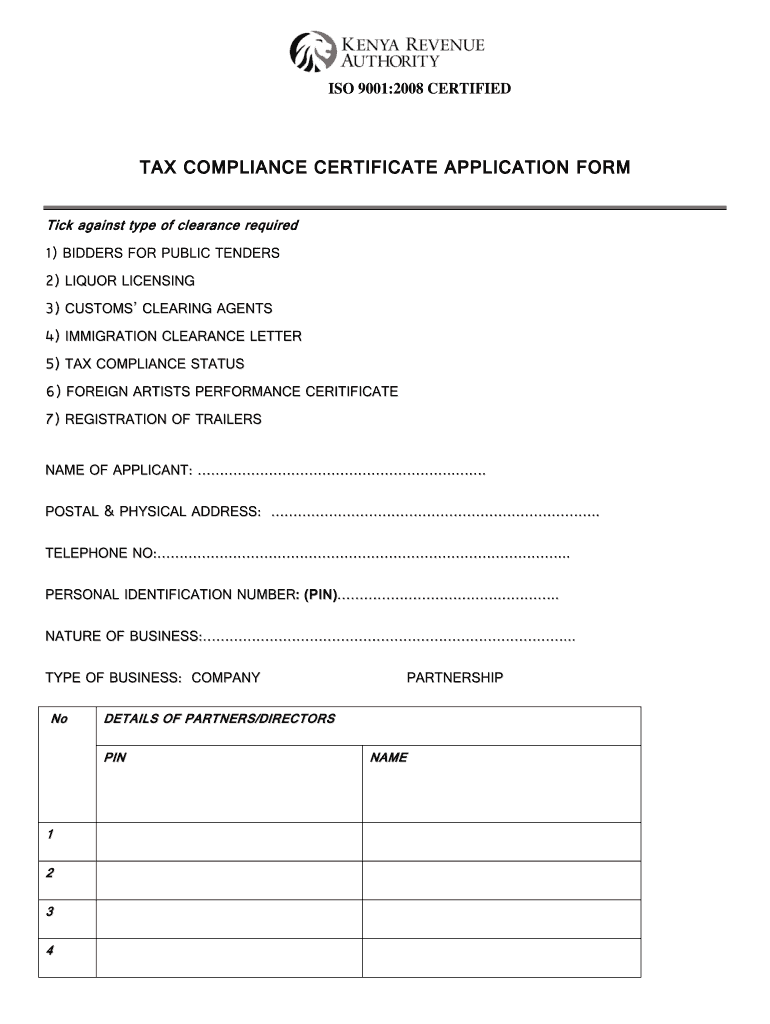

Application Letter For Tax Clearance Certificate How to apply online for your Tax Clearance

The CRA will send the legal representative an acknowledgement letter within 45 days of receiving the request for a clearance certificate. The assessment can take up to 120 days, assuming all of the necessary documents were provided. However, in certain situations, the CRA may need to do an audit before it issues the clearance certificate.

Kra clearance certificate Fill out & sign online DocHub

The estate tax clearance certificate is a document issued by the Canada Revenue Agency declaring that the deceased has satisfied all tax liability, including federal and provincial taxes, interests and penalties, he or she is reasonably believed to owe. The clearance certificate is issued pursuant to subsection 159(2) of the Income Tax Act.

Canada revenue agency t4e kasapeden

Subsection 159 (2) requires that legal representatives obtain a clearance certificate from the CRA. A clearance certificate certifies that all amounts for which the taxpayer is, or can reasonably be expected to become, liable under the Income Tax Act before the time of distribution have been paid or that the CRA has accepted security for payment.

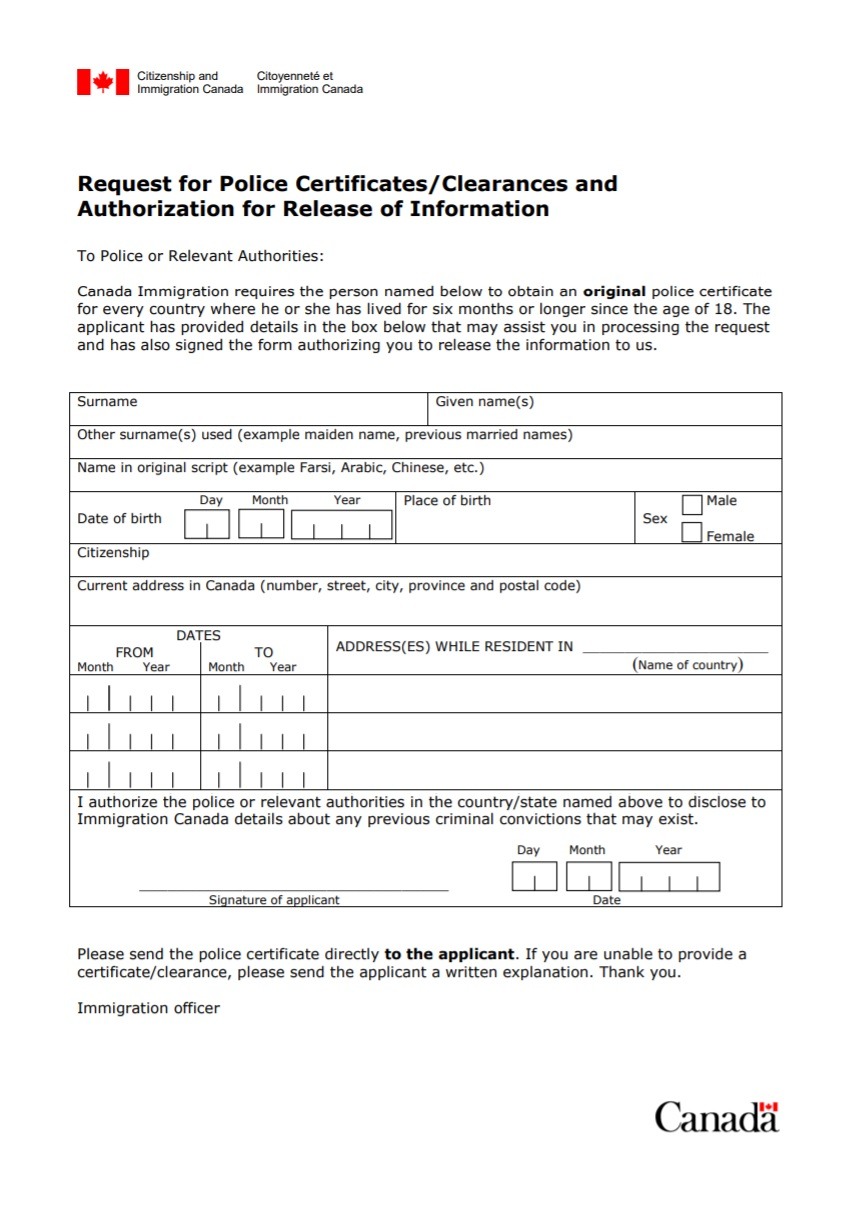

Canada Police Clearance Certificate Fill Online, Printable, Fillable, Blank pdfFiller

The Clearance Certificate: What it is, and why it matters James Dolan February 2019 Advisor's Edge Providing executors with peace of mind One of an executor's most important jobs is to obtain the clearance certificate: written confirmation from the Canada Revenue Agency that the deceased (and the

Revenue Services Sign Up and Login Portal www.canada.ca/CRA Updates Current School News

A tax clearance certificate is a document that the Canada Revenue Agency issues to the legal representative of a taxpayer, including a person, estate, trust or corporation, declaring that the income tax owing by the taxpayer and applicable interest and penalties have been paid. A tax clearance certificate is issued by the Canada Revenue Agency.

Canada revenue agency forms 2016 vanpsado

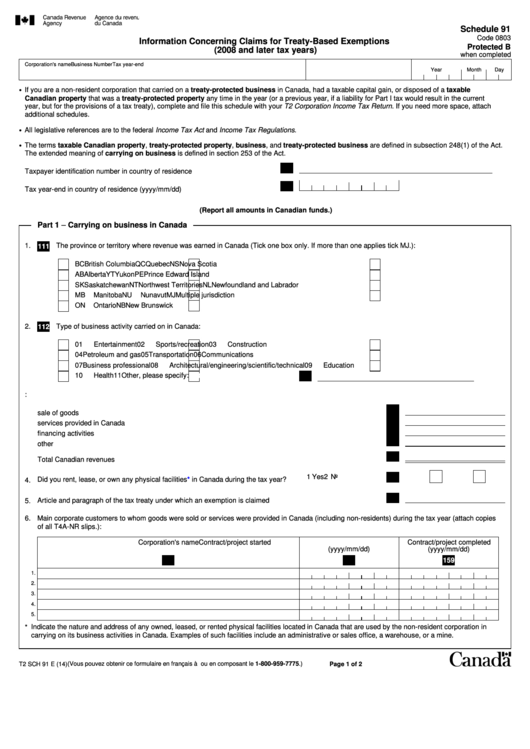

All non-resident individuals who dispose of a property and who are required to notify the Canada Revenue Agency (CRA) of the disposition should have a Canadian taxation number.. Tax Shelter Identification Number or Clearance Certificate". Click the "Next" button. Select submission reason: Select "Send request for Certificate of.

How to Login to Canada Revenue Agency (CRA) Account 2023? YouTube

1. An enquiry that is specific to a given charity or a donor and needs research or analysis, as well as consultation with internal stakeholders. 2. Date modified: 2024-04-22. A listing of service standards that state the public commitment of the CRA to a level of performance that you can reasonably expect when getting the service under normal.

11+ Police Clearance Certificate Templates Free Certificate Templates in Word, Excel & PDF

A Tax Clearance Certificate issued by Canada Revenue Agency confirms that all amounts owing to Canada Revenue Agency by the deceased and/or the deceased's Estate have been paid. With a Tax Clearance Certificate, the Executor can be certain CRA will not be able to hold the Executor personally liable for any unpaid taxes.

Director's Liability Assessment with the Canada Revenue Agency

Obtain a Clearance Certificate. The distribution of the estate should be postponed until a clearance certificate has been obtained from Canada Revenue Agency. The clearance certificate verifies that there are no funds owing to the government. Without it you can be liable for any amount the deceased owes. Prepare a Proposal for Distribution

2012 Form Canada TX19 E Fill Online, Printable, Fillable, Blank pdfFiller

Canada.ca; Canada Revenue Agency; Forms and publications; Forms listed by number - CRA; T2062 Request by a Non-Resident of Canada for a Certificate of Compliance Related to the Disposition of Taxable Canadian Property Download instructions for fillable PDFs.